Advertising on Amazon isn’t for the faint-hearted or financially feeble seller. Merchants need wits and wad to make a dent in their Amazon sales projections.

The question isn’t whether Amazon has the market size or sufficient buyers’ attention to drive sales—the eCommerce giant has more buyers and store visits than anyone could ever wish for. It commands over 4.1 billion visits monthly and 148.6 million Amazon Prime members in America alone entrust their shopping needs to Amazon.

For Amazon merchants, the chances of ranking for their most important keywords, getting the sale, and remaining in business are becoming grim. Ad costs are growing and you need reliable data to bring them down and consistently remain profitable.

Enter Downstream Impact.

Downstream uses machine learning to help you understand your ad spend and best-performing ad efforts. The platform uses contextual advertising to help sellers make better decisions on their ad spend.

Contextual Advertising With Downstream Impact

According to eMarketer, marketers will spend over $17 billion to advertise on eCommerce apps and sites in 2021. This spike in merchant spend on ads means competition will go up too.

Luckily, that’s the problem Downstream helps you solve. The platform uses contextual advertising to give you a competitive advantage.

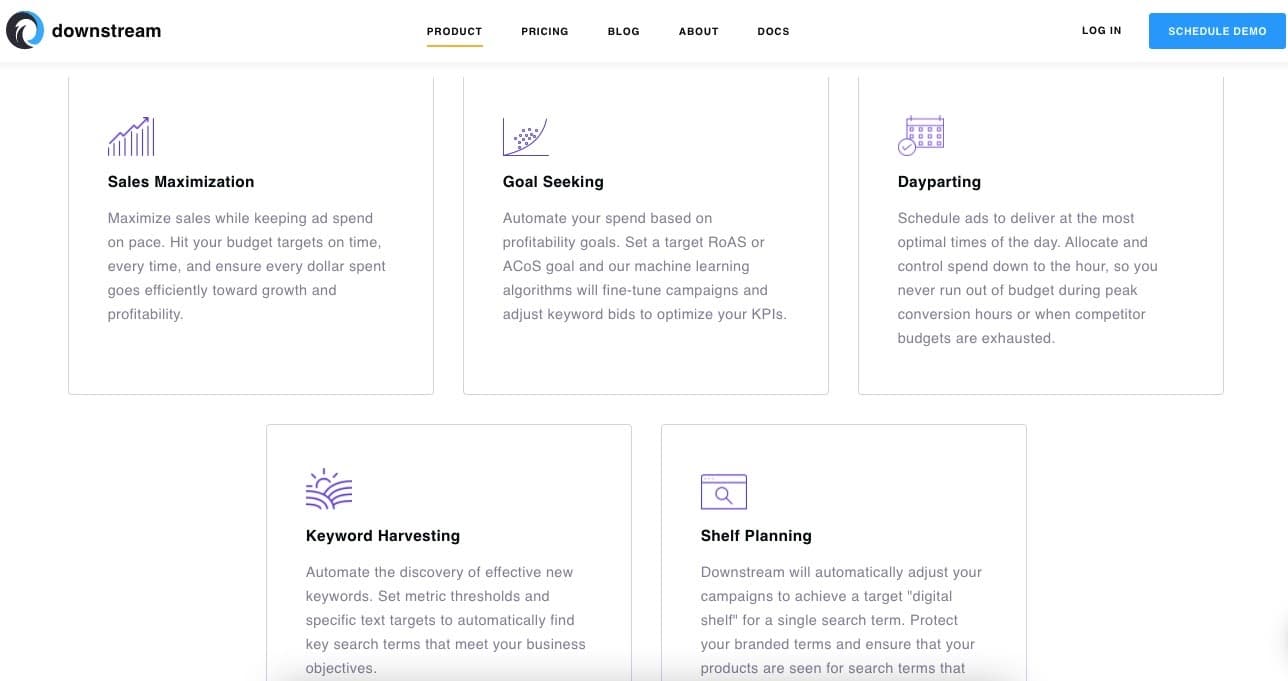

They help brands understand their customer behavior first-hand, reduce the complexity of ad-related business processes, and save on their advertising spend. You can automatically optimize campaigns with important metrics and have the freedom to choose your KPIs. Then, leave the rest to Downstream while you focus on production.

You can track your product’s ranking and know your competitive edge by monitoring search trends. This information helps users maximize their marketing efforts.

Besides tracking performance, you can wield a lot of control over the direction of your ads and campaigns. Downstream lets you choose how to group your products, keywords, and campaigns.

The dashboard is highly customizable and shareable. Downstream lets you store your data beyond Amazon’s 90 days, so you can make long-term forecasts and better business decisions.

Key Takeaways From the Interviews

This interview will enlighten you on how to automate your Amazon advertisement effectively using Downstream Impact.

Here are some key points to note:

- When starting a business, you might need to do things that don’t scale, like reaching out to your network or ask friends and investors for introductions.

- Most of the activities that you start out with don’t necessarily scale your business

- In contextual advertising, it’s very important that you understand how, where, and when people are shopping.

- It’s important that Amazon sellers or vendors in today’s environment use cutting-edge technology to their advantage.

- Compete in product categories that fit your brand.

- Amazon records actual conversion by tieing every sale back to customer clicks with a direct two-week last-click attribution.

- With Amazon, you’re able to identify consumer behavior, trends and glean insights by looking at the point of sale of hundreds of millions of global customers.

My Conversation with Connor Folley

1. Hello! Please tell us about yourself and your professional background?

Yeah, absolutely. My name is Connor Folley.

I’m the co-founder and CEO of Downstream, which was recently acquired by Jungle Scout, where I’m now Vice President.

I live in Seattle and I’m a former Amazonian with deep ecommerce expertise.

2. I’m curious to know why you called this company Downstream Impact. Why did you choose that name?

Yeah, that’s a great question. When I was at Amazon, the concept of Downstream Impact, became a major focus for our retail business.

Essentially attempting to take a longer view on how our activities impacted our business. You know on the internet, We’re often looking at a single point in time.

So, sales-per-click or impressions, click-through rates, the ROI on a transaction by transaction basis.

But we should really take more of a lifetime value view of how we invest our efforts. In terms of our online businesses. If someone comes along and signs up for a Prime subscription or subscribes and saves.

The impact of that action, 12, 18, 36 months in the future is far more relevant than what was clicked and purchased during that single shopping session.

So, that’s where the name Downstream Impact came from.

3. What Pain point did you identify? Specifically, you focus on Amazon advertising. So, what did you see there as a problem that you’re trying to solve?

I left Amazon about five years ago because I witnessed firsthand the explosive growth of Amazon’s advertising business. But also, how uniquely challenging it was for brands and sellers to manage and scale their advertising spends.

Amazon has continued to put more and more of the workload required to manage your business on the platform in the hands of these suppliers.

But, for most of these brands and agencies, and sellers, they’re not necessarily well-prepared for that workload. And have needed to retool in the form of new software.

And so, I began discussing this opportunity with my co-founder, Salim Hamed. We co-founded Downstream in late 2017.

Our goal is to create the dominant solution to allow brands, agencies, and sellers to better measure, manage, and optimize their Amazon advertising.

We participated in the Techstars Accelerator program, raised venture capital from some of the top investors out there.

And we’ve been growing very quickly working with top brands like HP and Bic and top agencies like Marketplace strategy.

This month, we merged with Jungle Scout and are thrilled about the value that this will unlock for our customers.

4. Did you rely on venture funding to grow right from the beginning? Or did you start acquiring customers before you got venture funding?

Great question. Yeah, it was a mix.

So, we definitely did some bootstrapping with services earlier on. We did have some early pre-order contracts because there was such a gap in the market for what we were building.

There was an appetite out there from some very large brands. And so we had the good fortune of connecting with them and early pre-order deals that bonded some of our growth.

But for the most part, it was venture capital that allowed us to ramp up quickly, and hire a team of super talented engineers and begin building our software.

5. How did you get your first customers, the first people who bought and believed in your product to jump on board?

So, you know, your first ten customers, it’s really by hook and by crook. You know, anyway that you can possibly acquire these customers.

And primarily its networks and personal relationships earlier on.

You know, they say with early startups, you should do things that don’t scale.

And that’s very true with those first ten customers. Because certainly, it’s not a repeatable sales motion to be reaching out to your networks, asking friends and investors for introductions.

But you do what it takes early on to get those first few customers.

6. Can you explain how downstream uses context to help users optimize ads on Amazon?

Yeah, absolutely. So, in terms of contextual advertising, understanding how, where, and when people shop is very important.

And trying to target them based on using the right keywords categories and adjacent products in exactly the right place is important. And the right time of day is just critical in being able to optimize your advertising on Amazon.

And our technology allows our customers to better target the Amazon customer based upon all those factors.

Whether it be getting the correct keywords that are going to reach the right customers, looking for that product.

Having their products surface in the correct categories, alongside products that are contextually relevant to that customer.

For instance, customers shopping for razors, putting it next to shaving cream on a detail page at the right time of day.

And that’s really critical to understand because, on Amazon, you have so many categories and so many different types of customers.

If I’m selling printer ink, I don’t necessarily want to be advertising that outside of Monday through Friday nine to five. At this time, people are at work primarily purchasing ink and toner.

On the other hand, if you’re selling toothpaste and household light bulbs, for the most part, that’s being done before work hours and after work hours. When people are at home and realize I’ve run out of toothpaste, or the lights are out in my bathroom.

So, time is also a very critical contextual element to consider and Downstream allows you to better target based on all those factors.

7. Everyone knows that there’s an Amazon rush right now. Small businesses are going on Amazon and the platform is growing year on year. The question is, with all of this competition, how are you able to build a product that serves people who are in the same market, probably targeting the same audience, but they rely on your products to do a good job of using ads to drive sales. How do you make this possible?

Yeah, I’m glad you asked that.

In today’s Amazon environment, these brands are at a pretty big competitive disadvantage if they don’t have powerful technology on their side.

So, assuming that you’re trying to manage and optimize your Amazon advertising, and you’re targeting your customers manually. There’s only so much time a human being has during the course of the day to be able to take these actions.

But, at Downstream we provide machine learning automation that is operating 24/7, 365 on your behalf.

Making millions and millions and millions of optimizations every single day on behalf of your brand.

Out there exploring a vast set of keywords that you would not have the opportunity to be able to test and optimize.

So, it’s really a matter of scale, that allows you to have a distinct competitive advantage.

We also provide powerful analytics that allows you to peel back the onion. On what it is that is driving performance and fluctuations in your business to gain greater insights.

And also uncover new opportunities. So, it’s really imperative for the Amazon seller or vendor in today’s environment to have technology on their side. Because otherwise, they’re just operating at such a large competitive disadvantage.

8. Now, do you have any cases where businesses that have been selling on Amazon used your product and felt, “Wow! We never saw this?” People who discovered something about your product that made them stick around. Do you have numbers around that?

Yeah! We do have numbers and we have case studies that we’ve done. And I’d be happy to share some of those with you.

However, I’m reluctant to share specific performance metrics because I feel like they’re often fundamentally dishonest.

And here’s why. Let’s take two products, say a robot vacuums for $300 and disposable razors for $1. Those are such different products with different economic units such that the success that the robot vacuum customer experiences in no way translate to the customer who is selling disposable razors for a dollar.

So, simply providing some return on ad spend lift that my software can provide customers, and then I’m expecting to get the same lift or performance.

I’m either selling my product or I’m underselling my product based on your position in the equation.

And I’d always caution folks when they see metrics. They should ask themselves whether or not that actually applies to their business. Their unit economics, their competitive landscape, and the unique challenges there.

However, on balance, we have extremely satisfied customers. We’ve seen that on average with our customers, our machine learning automation will generate at least a 20% lift in their return on ad spend.

In some instances, it’s going to be much higher than that. There are also highly competitive categories where there’s just not that much left to extract in terms of ROI improvement.

9. From what you said, some categories are already super competitive, so it’s difficult to see a significant ROI with a little ad money in those categories. And this might not be the right direction for small businesses. Are there categories that you’ll advise small businesses to focus on?

That’s an interesting question, so let’s take a step back.

An important context on Amazon is you’ve got third-party sellers and you’ve got first-party vendors.

And if you’re a third-party seller, particularly a reseller, you have a lot of freedom in what you choose or choose not to sell on the platform.

Software like Jungle Scout allows you to find opportunities and evaluate the competition. And understand whether or not this is going to be a fruitful product and category for you to invest your time and resources in.

Whereas if you’re a first-party vendor and you work for a basketball manufacturer, you’re selling basketballs, whether you like it or not. And so you have to go compete in that category.

Given that kind of context, there are some categories that if I had the opportunity to decide whether or not they sell and advertise products there, I would be reluctant to go into.

This includes areas with a huge consumer packaged goods players, with basically unlimited budgets. It’s going to be very difficult for you to gain any kind of share of voice and get your product in front of customers, in those categories.

But it’s worth keeping in mind also that some of those CPG categories or grocery categories have a tremendous amount of shopping volume in them. And so, while there might be large competitors, there can still be large opportunities because they just received so much traffic.

It’s not a simple decision. You’ve got to weigh a few different variables.

But I think there are some really powerful tools like Jungle Scout and Downstream that can also help with this. They can help you quantify the level of competition, the size of the opportunity, and show you how dense these advertising auctions are. Because that’s going to drive up your cost-per-click to understand whether or not the unit economics are going to make sense for you as an advertiser.

10. Can you say that competition always correlates with ad costs?

That’s a great question.

I mean, it’s a second-price auction, right? So you’re always going to be spending a penny more than the next closest competitor.

Theoretically, it’s not that straightforward on the backend, but that’s a general principle.

And so, yes, when you have more competition, you are going to see the costs-per-click increase. Because you get what’s called higher auction density. Simply meaning there are just more competitors in there.

And the CPCs go up and it just becomes more and more competitive to compete there.

Now, you can have one single competitor with just a massive budget who comes in, sets the bids a hundred dollars a day and their budgets are live all day and that’s gonna make it very expensive.

But, where you have more competitors, generally, you’re going to see higher costs per click.

And one interesting dynamic, as it relates to cost per click and competition, is the notion of Dayparting and how cost-per-clicks vary throughout the course of the day. Because every advertiser comes into the auction with a fresh daily budget for that 24 hour period.

So, what that means is that the auction is the densest in the first minute of the day. Everybody’s got a fresh budget.

Everybody’s in their kind of duking it out and their campaigns begin to run out of budget as the day goes on. And your cost-per-click will then go down throughout the course of the day as the advertiser’s budgets expire.

11. I’m curious about this. A lot of people use Amazon for general shopping and price comparison. Someone wants to buy a product locally, but goes to Amazon to check the price. I want to think that because of that search, there will also be a high demand for a particular keyword, even though it’s probably not commanding a lot of sales. So, how are you able to filter between keywords from those searches and keywords that actually command sales?

Yeah, I’m glad you asked.

You know, because it’s a cost-per-click performance model within Amazon-sponsored ads, we’re able to tie that click back to a transaction. And that’s the beauty of this whole Amazon advertising mousetrap.

And what has led to its explosive growth is that it has two-week last-click attribution, meaning I can tie every sale back to the customer click with direct attribution.

Typically in digital advertising, it’s impression-based attribution. So, if you saw the ad and then purchased it at some point later on that attribution flows through.

But in all likelihood, you’ve seen multiple display ads at that point. It gets a little fuzzy as to whether or not you can cleanly correlate it back to that ad that you saw.

But with a click, that’s very specific. We are able to tie back the actual conversions.

So, it’s the beauty of this platform where you don’t have to speculate. You know, that customer clicked and they bought.

When I say that it’s been driving their explosive growth. One needs to understand that as a marketer I will always seek the most demonstrably ROI for my advertising dollar.

I’m always going to spend my first dollar where I know it’s going to be the most effective.

You’ve probably heard the old saying that “I know half my advertising budget is wasted, I just don’t know which half.” Well, Amazon largely solves for that.

I can pay for actual conversions rather than just clicks or impressions. And I know that I’m getting a true ROI for that dollar.

12. What’s the best thing you’ve heard about Downstream from users? Something someone said and it just stuck with you.

Yeah. Our customers absolutely love us. So, we’ve gotten a lot of great feedback about our software.

We’ve had customers tell us that our software allowed them to free up an employee to do something entirely different within the organization. Whereas their time previously had been a hundred percent committed to managing their Amazon advertising.

And that was pretty cool to hear because that’s a pretty meaningful ROI.

We’ve had employees tell us that Downstream is an absolute game-changer for their business and that they wouldn’t know how to live without it.

We also are able to analyze how some of our reports are shared throughout the organizations.

We have seen instances within large public companies, where some of our reporting that is auto-generated is being automatically sent and scheduled to the global CMO or the CEO within an organization.

And it’s pretty cool to know that on a weekly basis, your reports are being surfaced at the highest levels.

13. Is there a Downstream feature that’s probably underutilized? You know it’s really powerful and wonder why people are not taking advantage of it enough?

Yeah. I love that question.

I’ve been preaching this gospel for years, in terms of the cross-section of consumer behavior that Amazon offers and Downstream also offers.

If you look at Amazon, you know what it’s like. About 150 million active customers per month. Never in human history have we had such a broad cross-section of consumer behavior.

And so, too often, I think we focus on it myopically like a retail channel. When in reality, it’s not dissimilar from being able to get sentiment analysis across Facebook or Twitter to understand what’s happening in the culture.

With Amazon, you’re able to look at the point of sale across hundreds of millions of global customers. To be able to identify consumer behavior, trends and glean insights.

And I often preach that the data we can provide you should be surfaced far beyond just the specific point solution users or stakeholders as it relates to Amazon.

Because, if I’m a Product Manager and I’m doing line planning for a sneaker company. And I understand that for our orange high-top basketball shoes, we’re seeing conversions up 20% month over month. And search behavior is up 40% week over week.

Wow! That should change my entire product line planning for the quarter. Because this is a very clear signal coming back to me from the consumers that something is changing out there.

So, I think that is an often under-leveraged and huge opportunity because you do get so much signal back from all of these customers on Amazon.

And it’s just a tremendous volume to have the opportunity to capture.