Blogging about personal finance is much like writing about personal development. These are productivity niches and they force you to show results, not aspirations.

The upside is that you can experiment with your life and share the results with others. So you don’t need to have a professional certification, skill, or talent to share useful ideas. With pure grit and discipline, you can become a master in such niches.

Whether you’re thinking of making money blogging this year or trying to decide on your niche, this interview is for you. You’ll gain practical insights from one of the most successful bloggers on the planet.

Michelle’s Experience Informs Her Niche

One of the best ways to niche is through your experiences. Your experiences are powerful because you can resonate with the realities. You can share personal victories and insights and your audience can relate to your story because you speak in their language.

That’s exactly what Michelle did.

Michelle used to be a part of the forty-five million borrowers in America who owe more than $1.5 trillion dollars in student loan debt.

But she turned all of that around. Today, that experience has become a very profitable one for her.

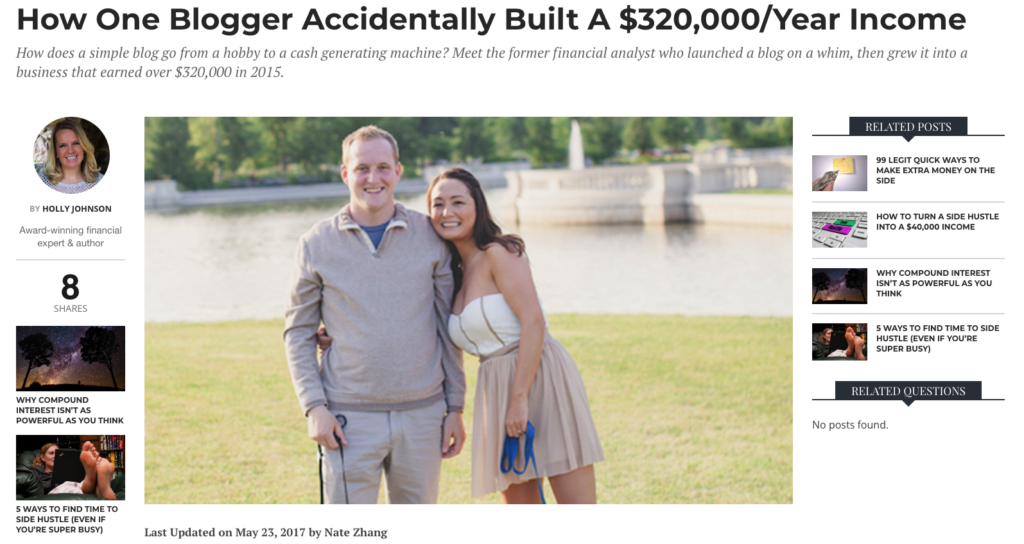

In this interview, we spoke with Michelle Schroeder-Gardner of MakingSenseOfCents.com. She talked us through her journey, from being enmeshed in student loan debt to making six-figures monthly through her personal finance blog. And yes, she does all these while living in a sailboat and traveling the world.

One might wonder if Michelle was just simply lucky to have achieved the aforementioned feat.

Michelle herself agrees in Question #8 that her blog’s success might be accidental, as she only started blogging as a hobby. Albeit, in Question 15, you’ll find the testimonial of students who have also achieved financial success by following her steps. Hence, we can conclude that Michelle’s route to financial freedom can be replicated.

My Discussion With Michelle Schroeder-Gardner of Makingsenseofcents.Com

Image credit: Instagram

1. Hello, please introduce yourself.

I’m Michelle Schroeder-Gardner, and I am the founder of Making Sense of Cents. Making Sense of Cents is a personal finance website that helps readers learn how to make more income, save more money, and live a better life.

I started my website in 2011, went full-time in 2013, and have been blogging full-time ever since. Starting a blog has been the single biggest life changer.

I currently travel full-time via sailboat and as I’m writing this we are currently in the Caribbean. We sold our house several years ago and have been traveling via RV and boat for many years now.

I am originally from a suburb outside of St. Louis, Missouri. I used to be a financial analyst and I also have three college degrees related to business and finance.

2. Making Sense of Cents is a self-explanatory name, but can you still walk us through how you came up with the idea and name?

On Making Sense of Cents, I talk about ways to make extra money, how to save money, being a digital nomad, travel, and more.

I came up with the website idea just on a random day. I didn’t plan on making money from my blog or anything like that – in fact, I had no idea that blogs could even make money.

I was reading a magazine one day, and in it, they featured a women’s financial website. Through there, I had discovered the personal finance blogging world and decided to start my own website. I was anonymous, and I created the blog to treat it more-so as a journal. I publicly talked about my personal finance situation, and it was a way to track my financial progress.

The way I came up with the name, Making Sense of Cents, isn’t a super interesting one. I didn’t spend a ton of time on the name and it was just randomly created.

3. What personal experience or realization inspired Making Sense of Cents?

Reading other personal finance blogs inspired me to start my own.

Seeing how others were able to live their life a little differently and have a different mindset, and seeing how it allowed them to get out of debt, retire early, reach their passions in life, and so on, motivated me to change my financial situation as well.

Although I have never been much for journaling, blogging on Making Sense of Cents was a great outlet for me. It allowed me to talk about my financial situation openly and receive help and opinions from other readers and bloggers. I have learned so much through my blog and I am constantly learning.

4. Going through your blog it’s obvious this was a personal journey for you – paying off your debts and saving more. At what point did you decide to make it public?

I think it was around one to two years in. I was anonymous for a while, as it was easier to openly talk about money and specific numbers without having to reveal who I was.

Eventually, it was just too hard to keep it a secret anymore – I always had to cover my face with pictures, use a pen name, and so on. I was also keeping it a secret from nearly everyone in my real life. Only my sister and my husband knew about Making Sense of Cents, so it was hard to keep it a secret for so long from friends and family.

So, I decided to publicly announce who I really was, and it’s been much easier this way. No more secrets, friends, and family all know about my website, I can use my real name, and I don’t have to hide my face in pictures.

5. Of all the available platforms to share your journey and knowledge, why blogging? Any specific reason why you went the blogging route and not the YouTube or podcasting route?

I don’t know if a YouTube channel or a podcast would have fit what Making Sense of Cents was in the beginning. I didn’t even think about starting a YouTube channel or a podcast- it just wasn’t something that I was interested in.

It was just me blabbering about my own personal finance journey in the beginning, and I was anonymous too.

I prefer to read content, so starting a blog was the best option for me. Plus, I didn’t have any plans to make money from it, so a YouTube channel or a podcast would have been a much bigger hurdle to hop over, especially as an anonymous person with no experience in podcasts or videos.

6. A June 2009 New York Times article implied that about 95% of blog sites do get abandoned by their creators. What kept you going in those early days? were there times in the early stages when you abandoned and revisited the blog. If yes, Can you please talk about this time(s)?

In the early days, I didn’t have any goals of making money from my blog, so I wouldn’t have done it if I didn’t enjoy it.

I enjoyed it a lot, so that was my motivation to keep it going.

I never felt that I wanted to abandon it and stop blogging.

7. What are the most difficult challenges you faced starting out? How did you overcome them?

I had absolutely no idea what I was doing, and that made blogging tough, of course!

But, since I started my blog entirely as a hobby, it wasn’t really overwhelming – it was more just a learning experience.

I make many mistakes, such as not having a domain name (I used to be senseofcents.blogspot.com), being on Blogger, and not knowing anything about blogging.

I overcame this by just learning as much about blogging as I could. Since I was blogging just for fun, I didn’t feel a ton of pressure. I learned a lot by making mistakes, watching webinars, reading other blogs, and talking with other bloggers as much as I could.

Image credit: blogtyrant.com

8. The investment zen article about your website described the success of your blog as accidental. Did you start your blogging journey with hopes of it being this profitable?

No, I had no plans at all of making money from my blog. It was all just a hobby.

When I started my blog, I had no idea what blogs were, that they could make money, or how they made money.

I was completely new to it and it was all just for fun.

Image credit: makingsenseofcents.com

9. With lots of informative blogs going the subscription route. Do you see yourself collecting a token in fees from your readers on a monthly or yearly basis?

No, I don’t have any plans going that route and I don’t think I’ve ever thought about it. Content on Making Sense of Cents is free and there are plenty of other ways to earn a living blogging. I like to keep my content open for everyone to learn from.

I don’t think I’ve ever seen a financial blog go the subscription route either.

10. Going through your website, I can tell you have several sources of blog-related income. Which of them can you say is the most reliable in terms of providing a steady source of income?

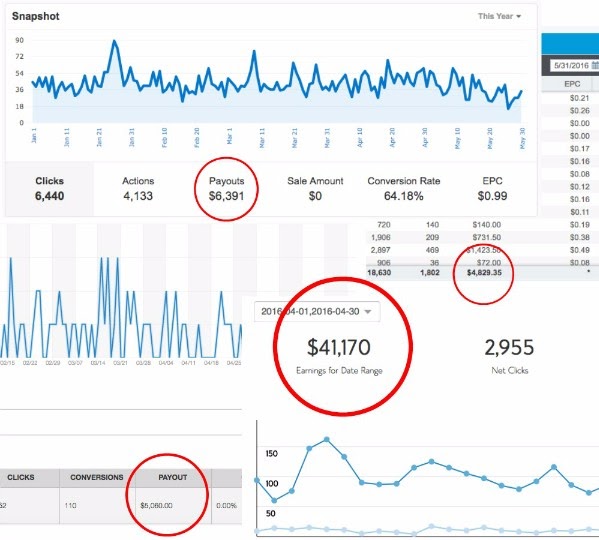

My favorite and most reliable is affiliate marketing income.

I have been earning affiliate income for years now and most of it is from articles on Making Sense of Cents generating income for years down the line.

Because I travel full-time, my internet isn’t always the greatest. Affiliate marketing income allows me to earn an income no matter where I am in the world or what time it is.

I count on affiliate income month after month to bring me an income, and it is very reliable. It doesn’t vary much – I write high-quality content and let that do the work for me.

It is something that I am extremely grateful for. It’s almost like passive income. I did work very hard for many, many years, and it’s nice for it to be paying off well into the future.

Image credit: makingsenseofcents.com

11. As an offshoot of the previous questions. Which of them brings in the most income and why?

Affiliate income, for sure.

I have been writing content on Making Sense of Cents for years now, so affiliate income just continues to grow off of that. It’s also my favorite way to monetize a blog, so I have spent a lot of time over the years to grow affiliate marketing on my blog.

12. What country makes up the bulk of your readership? Do you also think your advice and recommendations can be followed in other economic regions outside North America?

Most of my readers are in the US, but I also get a great amount of readers from around the world. I have a lot of readers in Canada, the UK, Australia, and many other areas.

Yes, my advice and recommendations can definitely be applied and followed by others around the world. I have received countless emails from readers in North America, South America, Europe, Asia, Africa, and Australia about how Making Sense of Cents has helped them change their life.

13. Making Sense of Cents has a large online community (Facebook following). Are there success stories from your followers that you’ll love to share?

I have heard from countless readers that I’ve helped them pay off debt, reach retirement, travel full-time, start their own business, and more.

It’s crazy to hear all of these great success stories, especially when I started my blog on just a random day with absolutely no goals with it.

It’s so amazing to help so many people all around the world. Even if I can help someone just understand one new financial topic in their life, I consider that a success. On Making Sense of Cents, I like to make talking about money NOT boring, and I believe that’s how I’ve been able to help so many people over the years.

14. We noticed you have two enrolment courses on your blog? Can you educate our audience on the benefits of these courses? Any guarantees?

Yes, I have two courses. I launched my first course, Making Sense of Affiliate Marketing, in 2016. It’s a very popular affiliate marketing for bloggers course and I am so happy that I created it.

Making Sense of Affiliate Marketing – This course is all about my affiliate marketing strategy and teaching bloggers how to earn affiliate income. It teaches affiliate marketing from the beginning, such as how affiliate links work, disclosures, all the way to improving your conversion rate, and negotiating with your affiliate managers. There are over 6,000 students in the course and it sells pretty well just through word of mouth.

Making Sense of Sponsored Posts – This course is all about how to make income through sponsored partnerships on a blog. This course teaches bloggers all about how exactly sponsored posts work, how to find sponsored partnerships, how to pitch advertisers, and so on.

Both courses have a 30-day refund policy. As long as you ask within the first 30 days, I have no problem with giving a refund. The percentage of students who have asked for a refund is quite low, especially for courses.

Image credit: makingsenseofcents.com

15. What’s the best review any of your students has given on taking your courses?

I have helped many very successful bloggers make money through their blogs. Several $1,000,000+ a year blogs were taught affiliate marketing either by my personal coaching or through my Making Sense of Affiliate Marketing course.

Some other great reviews:

- “I took Making Sense of Affiliate Marketing and after 2 years, I am now on track to make a mid-six-figure amount this year from my blog.”

- “Michelle was able to quickly identify what needed to be changed and within one month, my income rose 40% and has since quadrupled only 4 months after working with her! My income was $6,469.50 before I talked to Michelle, immediately jumped to $9,362.64 the next month, and is now $24,680.25 (four months later) and climbing!”

- Since taking Michelle’s course 5 months ago, my monthly page view average has been 36,715 but my affiliate marketing income has grown from an average of $272.94 per month to $4,400.19 per month. That’s more than 1,500% growth! Within just 5 quick months, I’ve made more than $21,000 directly from the affiliate marketing tips in this course…”

Image credit: makingsenseofcents.com

16. What’s the big picture? Where do you see Making Sense of Cents in the next five to ten years?

I hope to still be publishing high-quality content and helping as many readers as I can. I don’t really expect too much to change, other than normal industry changes (such as learning new blog growth methods).

17. Following the COVID-19 crisis, are there any changes you’re bringing to your Affiliate Marketing School?

Online work is thriving and growing at a great rate in this environment, so blogging and affiliate marketing is a great area to get into and be active in at this time.

I have been active in the community group by updating students on how they may be impacted by Covid-19 and what they can do to improve their business.

18. If someone who’s never thought of starting a blog got excited after reading your answers to these questions, what would you say to such a person?

I would recommend that they just start!

I hear from so many readers who say that they are nervous to start. That’s probably the top fear that I hear, and I probably hear that at least once a day.

People are nervous to start because they may not know what they’re doing, they’re afraid to put themselves out there by publicly writing, and so on.

But, you won’t know if you’ll like blogging or not if you just start.

Thankfully, blogging isn’t too hard to start and it’s a relatively low-cost business or hobby as well.

19. Is your point of discussion exhaustive? Do your old readers still follow-up with your blog or do they get to a point where they seem to know it all?

I’m always covering new topics, so I have many lifelong readers always wanting to learn more and more. I even have many readers who have been reading since I first started in 2011!

Money is a topic that you can’t really ever tire of – there’s always something new to learn.

I have yet to meet a person who knows it all about personal finance – not even me.

20. As an avid traveler, can you discuss a few lessons from your travels that have helped make you a better person?

Travel has taught me so much.

I have met so many amazing people, learned about so many different ways of life, and more, which has changed my life.

1) Patience. We’ve been sailing to many small islands, and I have learned a lot about patience. In smaller places, it can be more difficult to get mail, to get things fixed, and much more. And, when traveling by boat, it takes a long time to get anywhere, weather can delay you, and so on. Before traveling, I was quite an impatient person. But, now, patience is definitely an area that I have improved on. I try to enjoy each day and appreciate the small things in life.

2) Your mind opens. I have always been open-minded, but by traveling you really get to meet so many different people who are doing different things and living a different life. It’s exciting and interesting to see how the world goes round.

3) I appreciate life more. I am so grateful for all of the things that I have done and seen, and it makes me extremely grateful for the life that I get to live.

Image credit: Instagram

About MakingSenseOfCents.com

MakingSenseOfCents is a personal finance blog, chronicling the finance journey of its founder – Michelle Schroeder-Gardner. The blog teaches its audience to save more, earn more, and live more.

Michelle has been featured in Forbes, Cosmopolitan, Money.com, Oprah, CNBC, Reuters, Investopedia, TripAdvisor, HuffPost, Nasdaq, Mint.com, and dozens of other high-profile platforms.